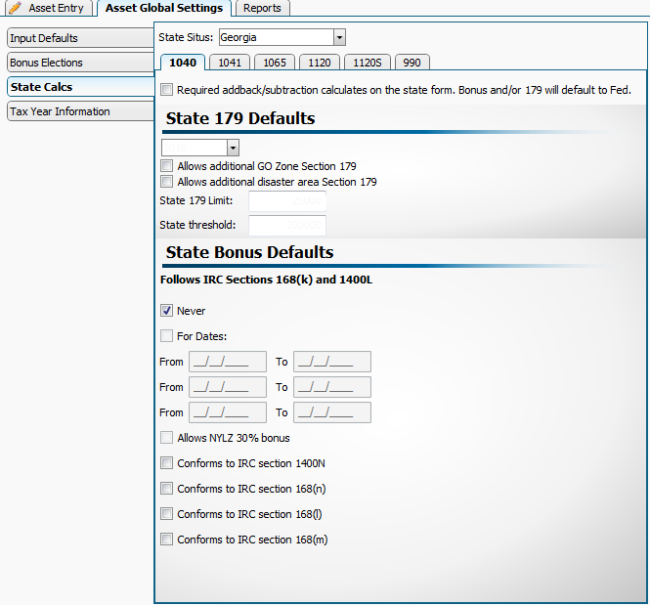

State Calcs Tab

State Calcs can be found under the Asset Global Settings tab. If you make changes to the Section 179 Defaults or State Bonus Defaults in either location, it will modify the calculations for all clients using that state.

Within the State Calcs tab, there are tabs for 1040, 1041, 1065, 1120, 1120S, and 990 entity types. Each tab contains information about the selected state’s compliance with sections 168(k) and 1400L as well as other pertinent information regarding state 179 limits, or whether or not additional Go Zone or disaster area Section 179 is allowable. Information is preset for each state and will be updated to reflect changes in future years.

State Calcs tab (Asset Global Settings)

Program updates will automatically keep the state Section 179 limits and Bonus defaults up-to-date with current legislation. You can override the state Section 179 limits if needed.

State 179 Defaults

- Select the year for which you wish to modify the section 179 limitations from the drop-down list.

- Select the appropriate check box for additional GO Zone Section 179 or additional disaster area Section 179 if they are allowed for the state.

- If the state has a section 179 limit other than the program default limit, enter the correct amount in the State 179 Limit field.

- If the state has a threshold other than the program default, enter the correct amount in the State threshold field.

State Bonus Defaults

This section is for display purposes only. Changes made to this section do not affect your assets.

See Also: